Healthybaby

Research & Strategy

Context

Healthybaby is pioneering a new standard of safety for babies with the first and only EWG VERIFIED™ diaper. Launching over the course of the pandemic, they weren’t able to get their footing with their true customer base and build the community they desired to cultivate. My role was to unpack why their brand wasn’t reaching a more full audience and understand where and how Healthybaby could create community.

My Role

Lead Researcher, Strategist, and Designer

Team

Solo Project with the input of the current CEO

The ask: Understand How New Parents Choose Diaper Brand

As an early stage startup, Healthybaby has experienced great success. However, there is still a lot more room to grow with connecting to new customers. It is known that once a parent decides on a brand, they tend to stick with it through multiple children, so how might we ensure that new parents resonate with the brand so that they start with Healthybaby and stick with the brand.

During this work, I questioned the clients assumption about who their audience is , how parents find out about new brands, and what factors ensure that parents resonate with a more expensive, yet safer offering. One of the main goals of this work was to build and execute a strategy for connection.

14 Parent Interviews

To begin this work, I wanted to speak to real parents or expecting parents who were in this exact position in order to understand what they value and how they make decisions. I built marketing materials, used social media, and my own networks to recruit participants. We were able to get over 85 potential parents and based on my screening protocol, narrowed down to 14 users and non users. The data collected by the 85 parents was also analyzed and used in the research study overall.

Analysis & Synthesis of Findings

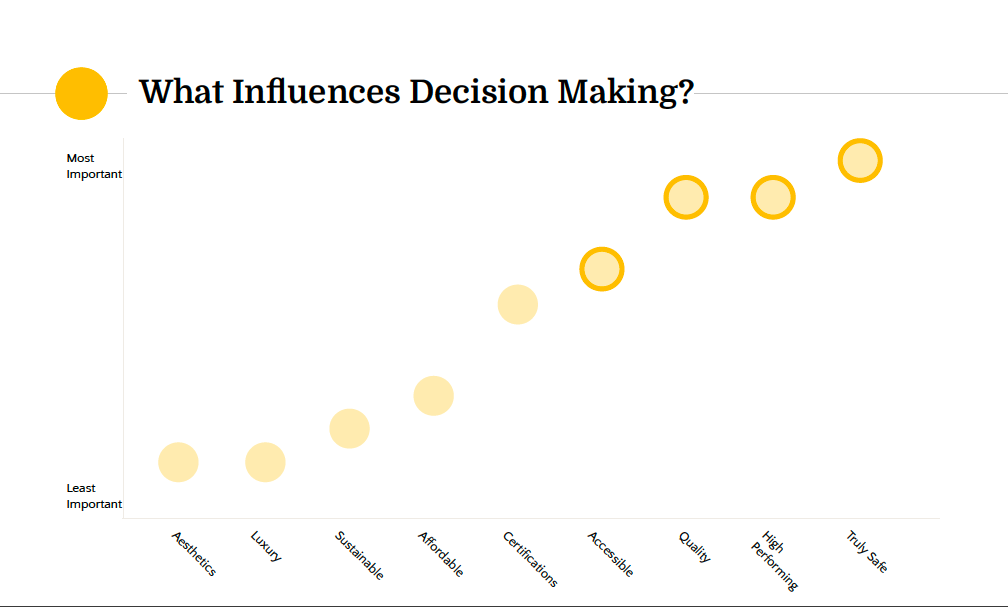

Truly Safe: Most parents mentioned how they wanted a product to do no harm, both now and in the future

High Performing: It needs to work well, and ideally as well as pampers.

Accessible: Speed of delivery matters, but ideally they would also like to have it in stores they frequent to “dummy proof” their shopping list.

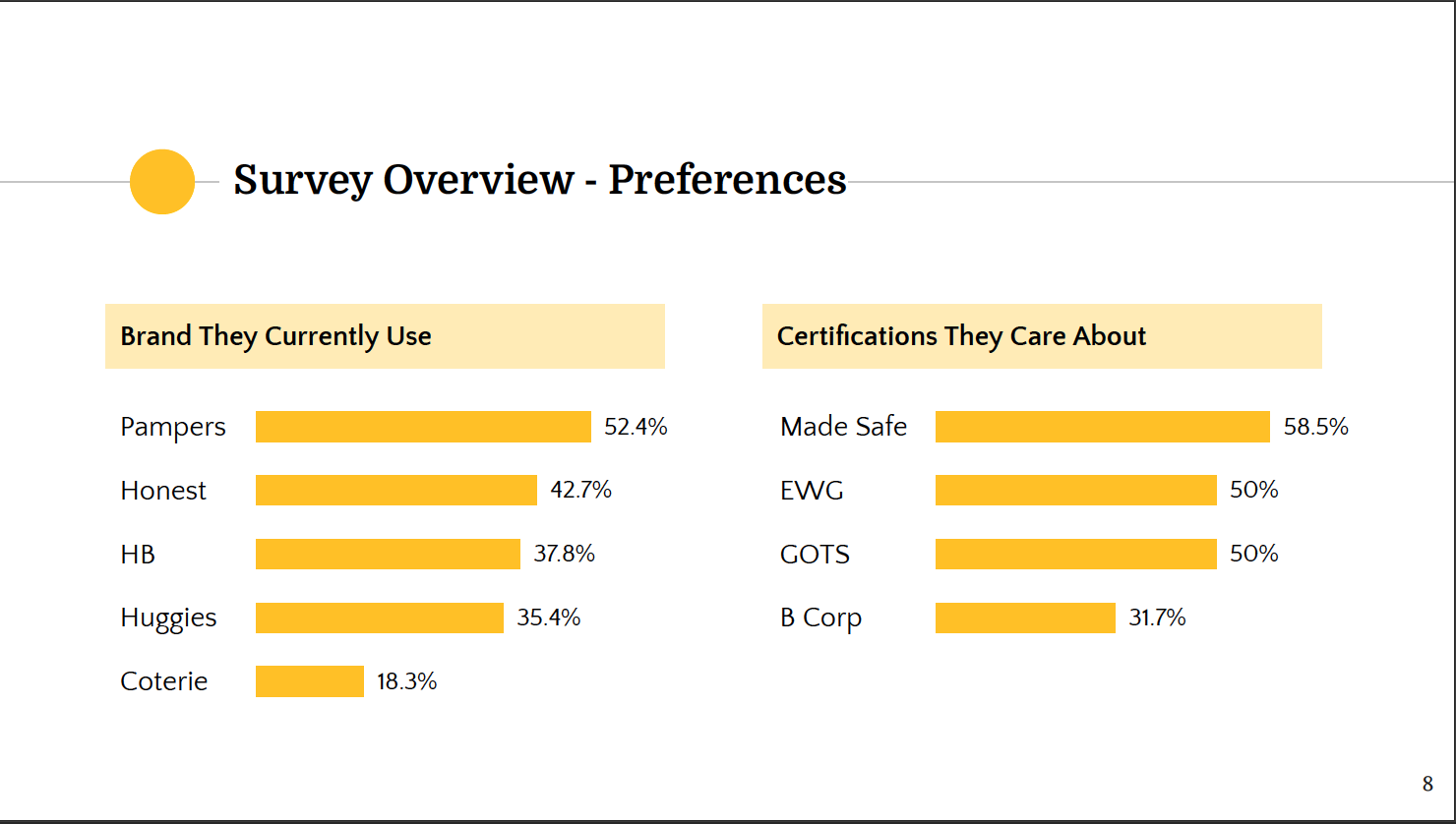

Based on the quant data from the survey of parents, we analyzed a few metrics of their behavior and brand use. A huge surprise in this demographic was that a majority of parents still use pampers.

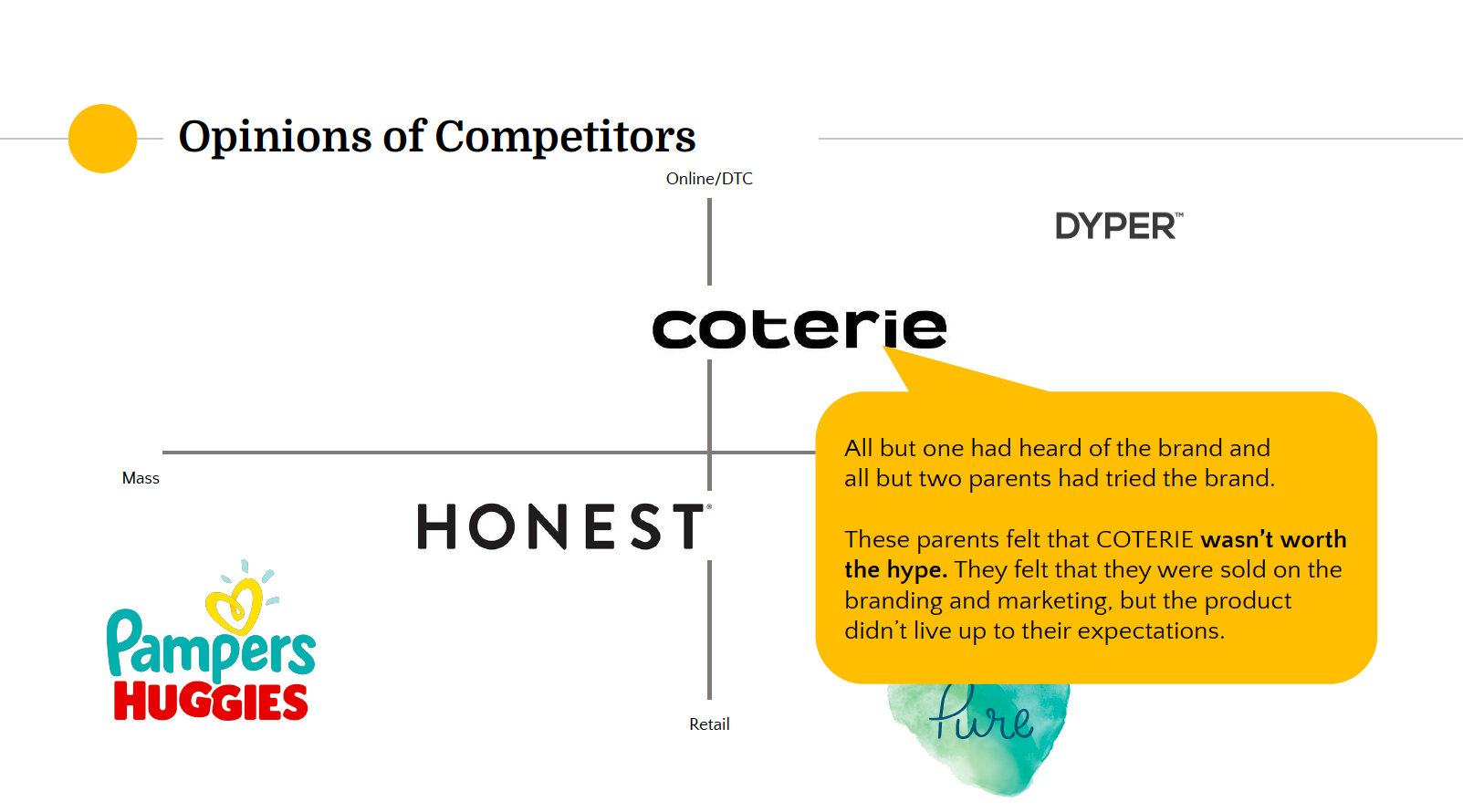

We completed various competitive landscape assessments and also spoke to parents about brand perception of each of our top competitors. We found that with our two main competitors there was a quality gap. Parents in this income bracket want the best for their children while still ensuring functionality - but they didn’t know who to trust.

Insights

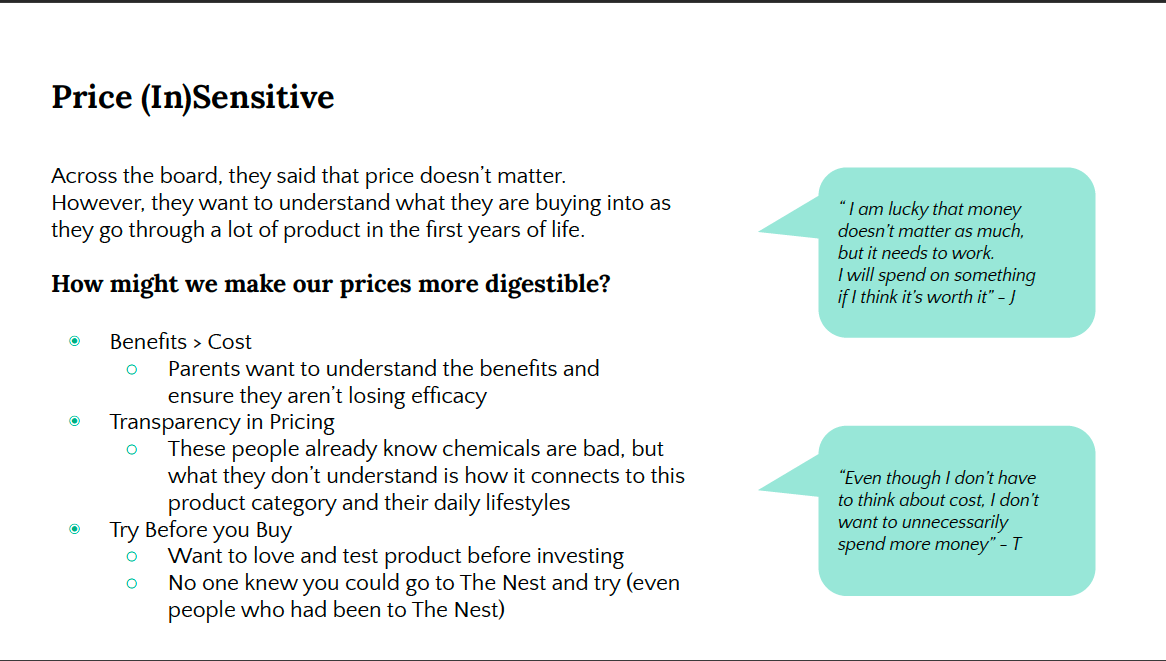

Price is Almost Irrelevant in this Category.

Even high earners don’t want to be wasteful.

The product has to work and preferably work as well as pampers

Parents Can’t be Perfect

Doing product research for every single product for a baby is exhausting. They need to find brands they can trust.

Convenience Shifts Values

Parents are busy and are in search of convenience. They want a reliable service that enables them to keep their values while maintaining their lifestyle.

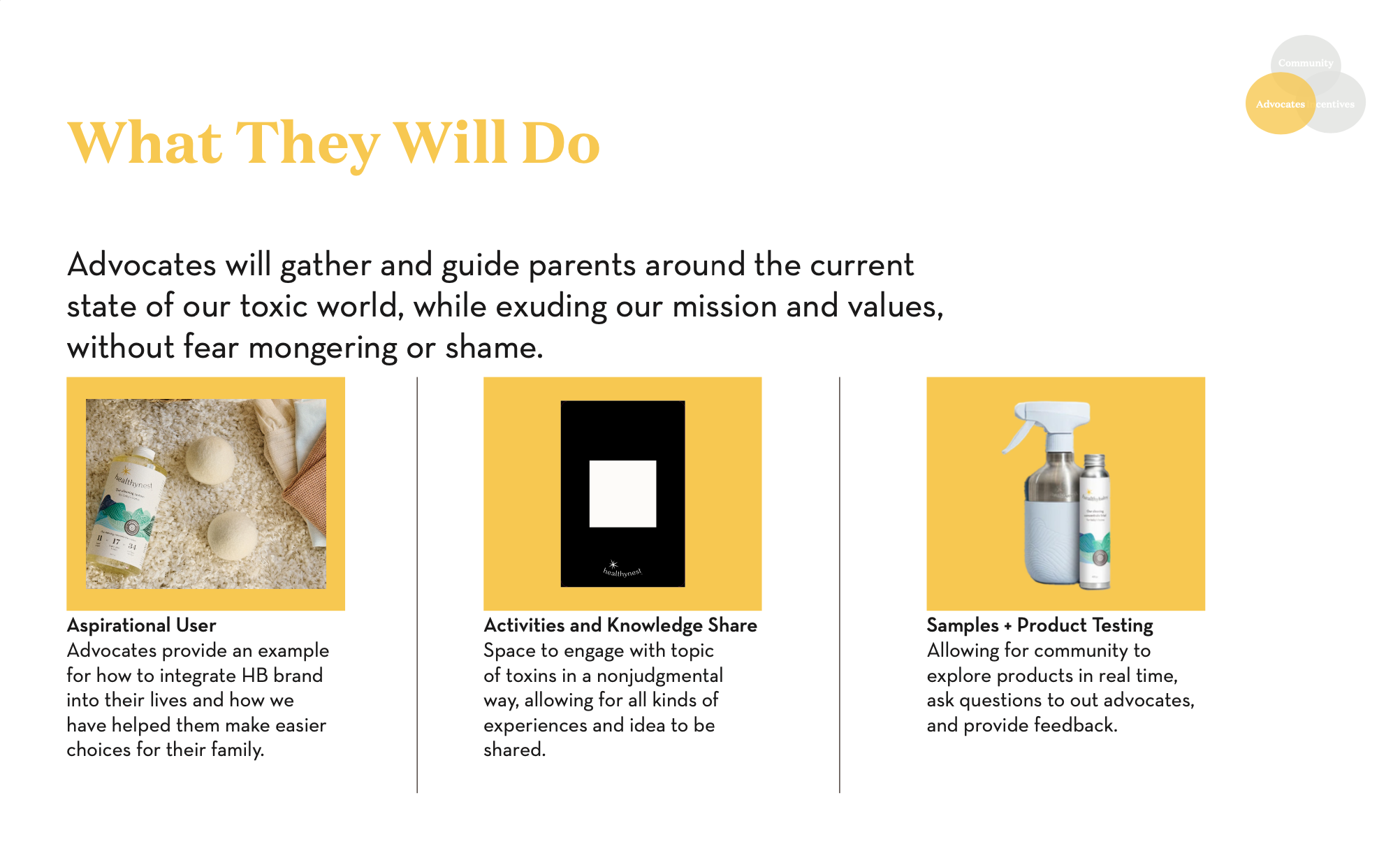

Our Solution: Community Representatives

I created areas of opportunity based on our researching findings. Our strategy was informed by meeting parents where they are, building connection, and teaching new parents about why Healthybaby makes a difference for baby and the planet. Some samples of our onboarding strategy below.

Pieces of our Strategy for Success

Our strategy was based on balancing these three themes.

Community: We wanted to build authentic parent networks to share knowledge and create true bonding all across America.

Advocates: Empowering brand advocates who are curious about the products and how they are different was another priority.

Incentives: Unlike other brand representatives, this wasn’t an hourly paid job - these parents are highly paid and skilled people, we had to come up with a structure that met their needs and showed we valued them as much as they valued us.

Results: Informed Strategy & Community Outreach

My research informed strategy across web, brand strategy, and community strategy. The brand representative strategy is currently being rolled out. We sent kits to all representatives in August and we currently have 20 parents involved in the program and are growing each month.

I continue to take part in this role as a parent myself.